51+ how much equity do you need for a reverse mortgage

Ad Put Your Home Equity To Work Pay For Big Expenses. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Pdf Implementation Of The Comprehensive Entrepreneurship Model For The Internationalization Of Eco Efficient Companies Jose G Vargas Hernandez Academia Edu

Web While there is no set limit on how much equity you need to qualify for a reverse mortgage LendingTree reports that 50 percent or higher is a good rule of thumb.

. A reverse mortgage enables you to withdraw a portion of your homes equity to supplement your income or to purchase a home. Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad No Monthly Payments.

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. So if your home is worth 500000 and you have 300000 in equity youd have 60 equity in the property.

Web While you may qualify for a reverse mortgage with as little as 50 equity in your home the amount of your potential payout increases along with your equity. Ad Compare the Best Reverse Mortgage Lenders In The Nation. The new five-year fixed rate.

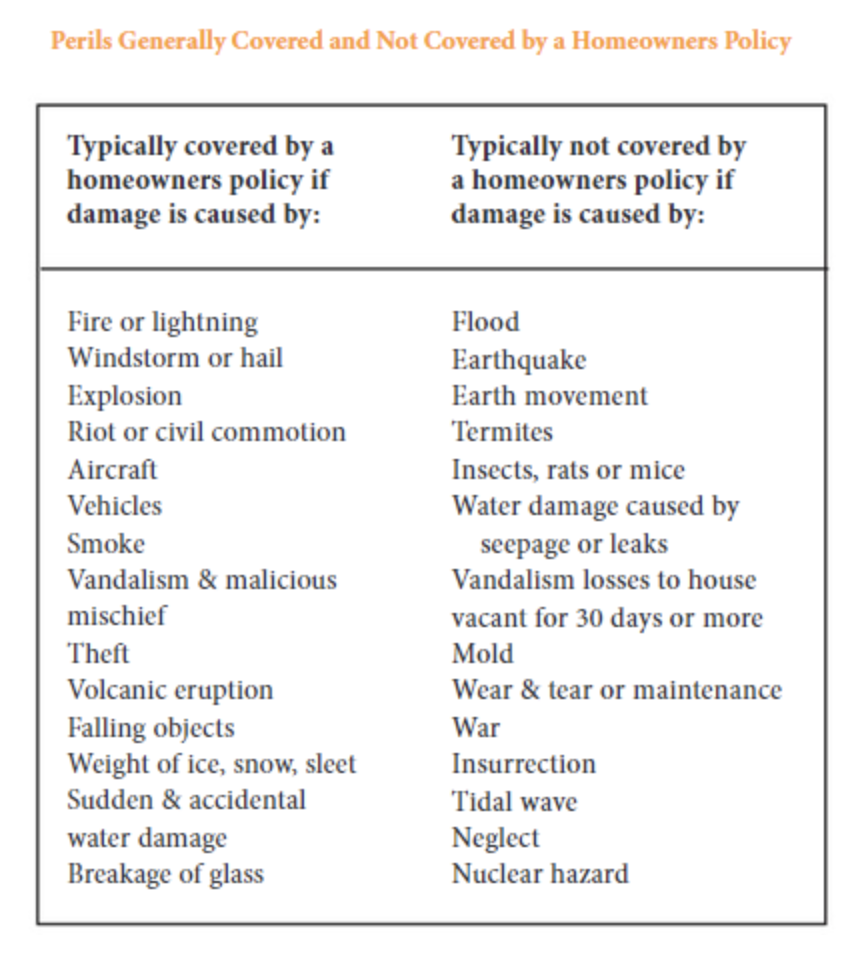

But if you still owe 250000 on your mortgage thered be no point in taking out a reverse mortgage because all of the loan proceeds would need to go to the first mortgage leaving you with no extra money. In addition the loan may need to be paid back sooner such as if you fail to pay property taxes or homeowners insurance or dont keep your home in good repair. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Generally the more equity you have in your property the more cash youll be able to access through a reverse mortgage product. There are no monthly principal and interest payments. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

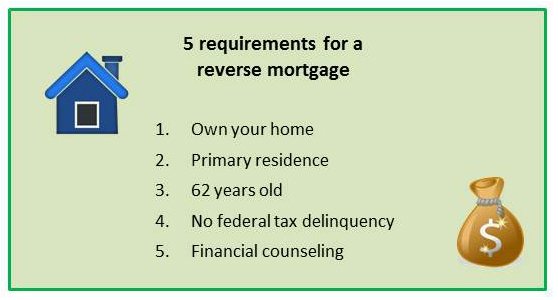

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. You must own the property outright or have at least paid. Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older.

1 reverse mortgage lender in the nation American Advisors Group at 1-888-998-3147. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Get Free Info Now. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50 equity or more Participate in reverse mortgage counseling Use the home securing the loan is your primary residence Reverse mortgage FAQs. Why Not Borrow from Yourself.

Web General reverse mortgage requirements include the following. Web Generally reverse mortgages require at least 50 or more in home equity. Web A round-up of the latest rate changes includes.

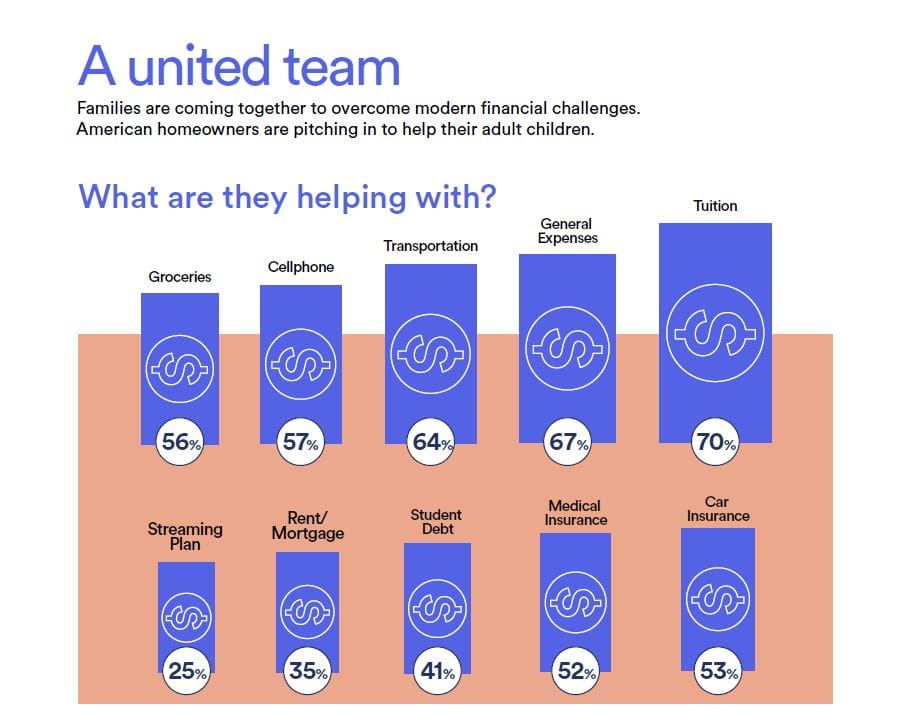

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. The additional eligibility requirements include. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes.

Web For more information about leveraging home equity in retirement or for help in accessing it through a reverse mortgage contact your reverse mortgage professional today from the No. Fixed rates have been cut by up to 024 percentage points for purchase remortgage and new build mortgages. How to Determine Market Value.

Web You can expect to need at least a 50 equity stake in your home to use a reverse mortgage though the exact share varies by lender and the specific reverse mortgage program youre using. Shared Equity May Be The Best Solution. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. With 100 equity you may be able to qualify for a lump sum payment of nearly 50 of. Way Easier Than A Reverse Mortgage.

Web In that case youd be able to borrow up to 47 of your homes value or 235000. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. You would be more likely to qualify for an HECM because you would have more than 50 equity.

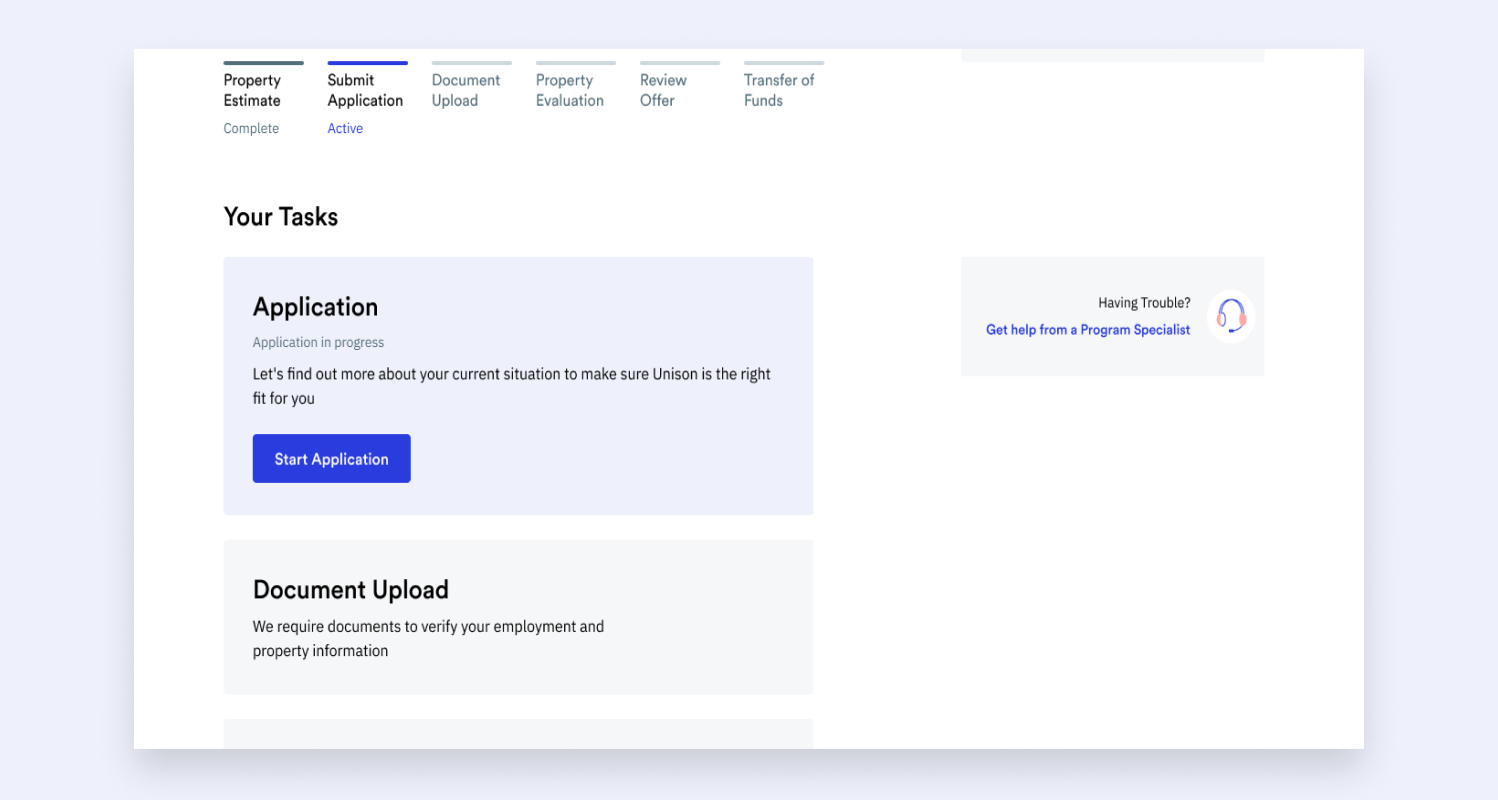

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reverse Mortgage Details Unison Home Equity Sharing Blog

What Is A Reverse Mortgage Explaining What A Hecm Is

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reverse Mortgage Realities The New York Times

Reverse Mortgage Details Unison Home Equity Sharing Blog

How Much Equity Do You Need For A Reverse Mortgage Lendingtree

Analysis Of Repayment Behavior Of The Retail Loan Borrowers Of Brac Bank Ltd By Md Papon Issuu

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgage How Much Equity Is My Home Required To Have Home Central Financial

Reverse Mortgage Details Unison Home Equity Sharing Blog

Most Reverse Mortgages Terminated Within 6 Years According To Hud

Calculating Equity In Your Home For A Reverse Mortgage

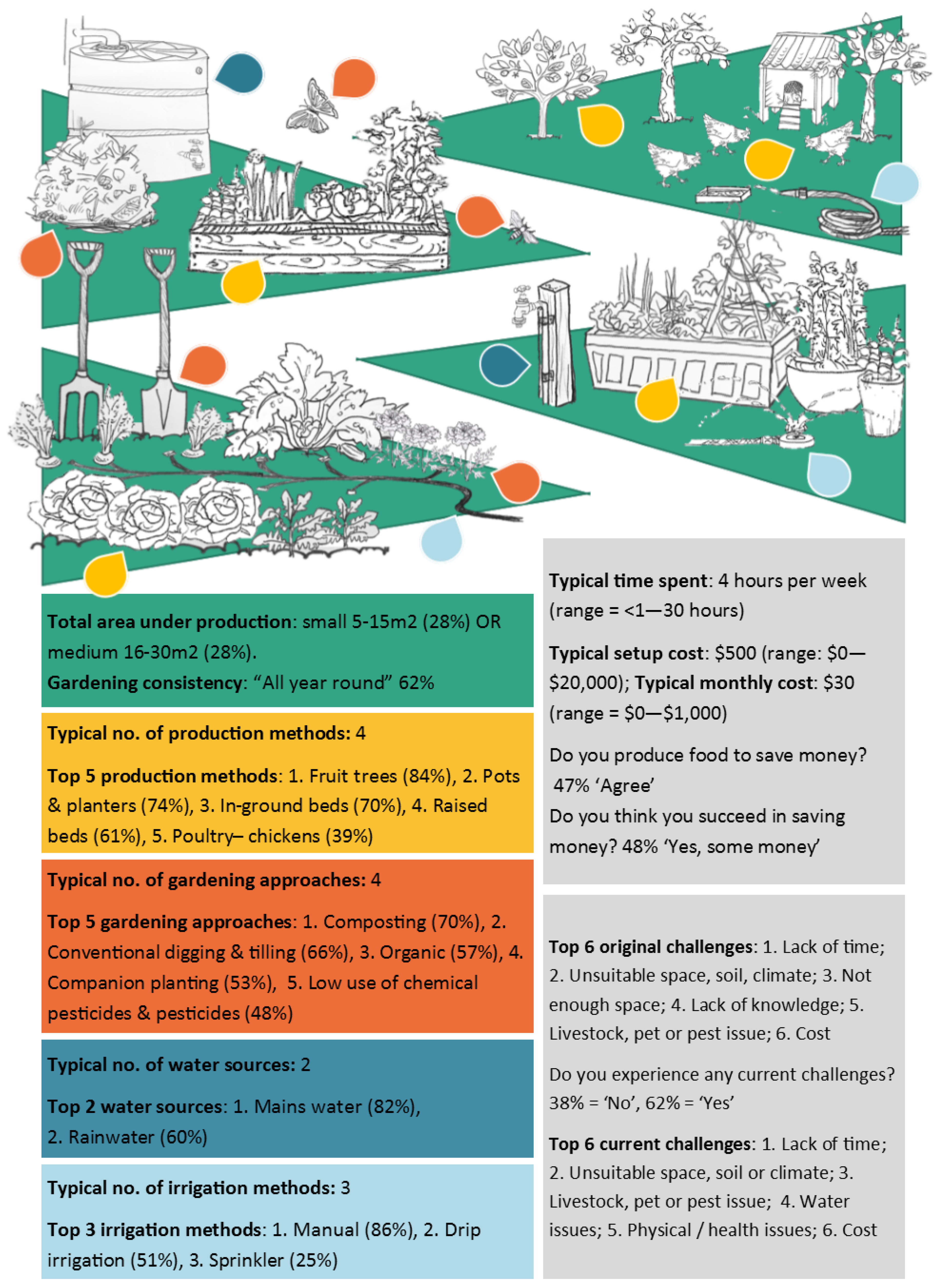

Sustainability Free Full Text Typically Diverse The Nature Of Urban Agriculture In South Australia

Reverse Mortgage Realities The New York Times